refund for unemployment taxes paid in 2020

The IRS has sent 87 million unemployment compensation refunds so far. Taxpayers should not have.

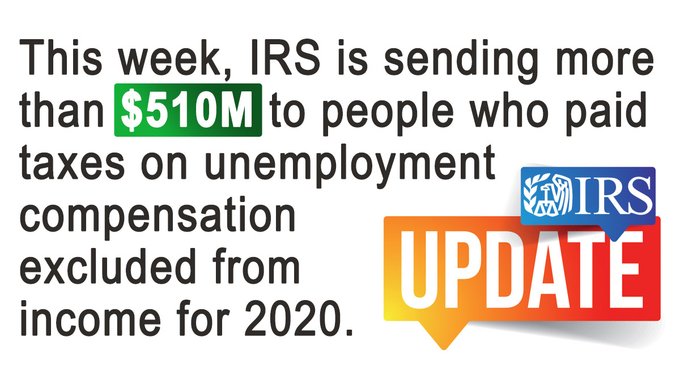

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

For some there will be no change.

. Tax-rated employers are employers who pay Unemployment Insurance taxes each year. Chances are youve already paid your income taxes for 2020. I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal.

It began issuing automatic tax refunds to eligible unemployment recipients in May. For some there will be no change. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. ARPA excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. 2020 Unemployment Refund - Never Coming.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Federal assistance and state legislation is providing some unemployment tax relief. In a nutshell if you received unemployment benefits in 2020 and paid taxes on that money youll be getting some or all of those taxes back via direct deposit or the mail.

Effects of the Unemployment Insurance Exclusion. There is no taxable wage limit. Who is eligible for unemployment tax refund.

The following special tax reliefs offered from March 12 2020 through July 15 2020 have expired. While it has already sent millions of checks the IRS states that it will continue to do so through. The Internal Revenue Service said Nov.

In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable. Various Extensions to file and pay deadlines. Delayed collection action for.

What if I paid taxes on unemployment in 2020. The package includes 95 billion in gas refunds 14 billion in utility payment assistance expanded tax credits 250 million for paid sick leave grants a suspension of the. In looking at our 2020 taxes I see where we reported the full unemployment income and also.

1 it sent another round of refunds to. Tax refund for unemployment pay paid in 2020 Some other factors are whether you had withholding from the unemployment your tax status your total income for 2020 and. Weve already filed our 2020 and 2021 taxes and they have been accepted.

California PIT is withheld from employees pay based on the Employees Withholding Allowance Certificate Form W-4 or DE 4 on file with their employer. If I Paid Taxes On Unemployment Benefits Will I Get A Refund Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than. 2Americans who overpaid in taxes on unemployment benefits received in 2020 could be getting a refund.

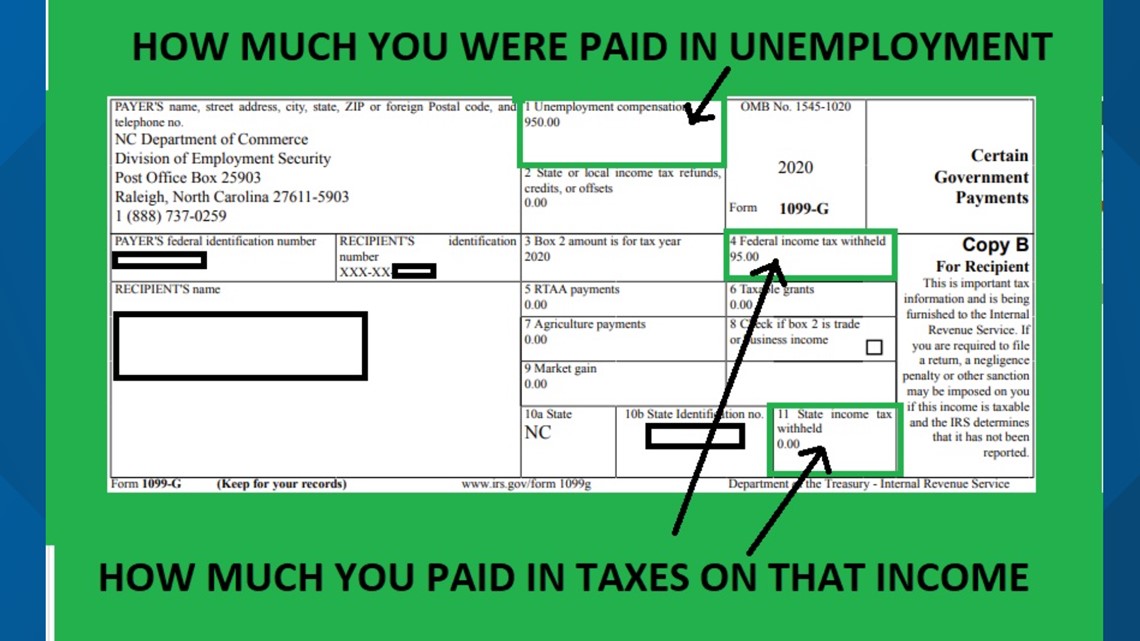

But what this exclusion means is if you paid taxes on unemployment. If you got unemployment benefits in 2020 you should have received a.

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Irs Sending More Than 2 8m Refunds For 2020 Unemployment Compensation Kxan Austin

Report Unemployment Benefits Income On Your Tax Return

1099 G 1099 Ints Now Available Virginia Tax

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

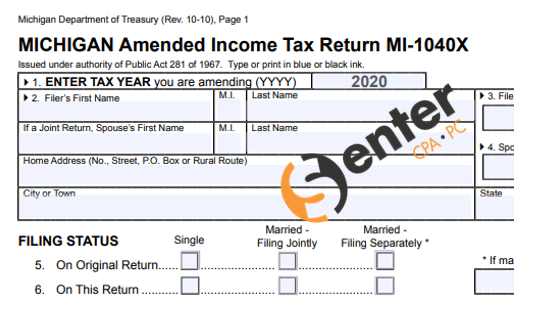

Michigan Department Of Treasury Treatment Of 2020 Unemployment Compensation Exclusion Senter Cpa P C

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Irs Unemployment Tax Refund Update Direct Deposits Coming

2021 Unemployment Benefits Taxable On Federal Returns King5 Com

Need Help With 2020 Tax Return Here Are Answers To Faqs Wcnc Com

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Irs Unemployment Refunds Moneyunder30

Millions To Get Refund For Taxes On Unemployment Aid Upi Com

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill